Negotiations Between Advertisers and Media

First Consideration: Timing Matters

Firstly, it’s important to note that the presidential elections will be held on Sunday, June 2nd next year. Therefore, the first thing to consider is that advertising saturation will impact the 1st and 2nd quarters. This contrasts with the 4th quarter, which is where most advertising budgets are concentrated: the 3rd and 4th quarters account for nearly 60% of the investment made in television by advertisers.

So the first piece of advice is to stay calm; it’s not as alarming as it might seem—the year is long.

It’s true that, unlike previous years, television networks have advanced their commercial policy communications and are aiming to expedite negotiation processes. It appears we will have a year with a significant number of companies closing early, followed by a period of calm, and then many companies will engage in late negotiations. This is mainly due to the fact that election years are periods of economic uncertainty. However, the latest report from October 2023 by the IMF has just published very positive data, showing an expected economic growth of 3.2% for Mexico in 2023 and 2.1% for 2024.

SECOND CONSIDERATION: INCREASE IN INVESTMENT DURING AN ELECTION YEAR

There is no data to suggest that presidential election years lead to increased TV investment by companies. As seen from the investment data of 2012 (Enrique Peña Nieto) and 2018 (Andrés Manuel López Obrador), the investment behavior was contrary: in 2012, there was an average increase of 6.9% in TV advertising investment by companies, while in 2018, investment contracted by 1.3%. Being an election year does not affect TV advertising investment; rather, it is significantly influenced by economic prospects, which are in turn impacted by political factors.

Therefore, the fact that it is an election year should not lead us to expect either an increase or decrease in investment.

What we should consider is that TV investment increased by 3.9% in 2023 compared to the previous year. Additionally, as previously mentioned, Mexico’s economic outlook for 2024 is positive; the inflation rate as of August was 4.64%, with a downward trend over the past 12 months.

Third Consideration: Does the Law of Supply and Demand Affect the Price?

We would like to debunk the “urban legend” that, in an election year, television networks will receive extra income, which will create a “strong” negotiating position with companies.

It’s important to understand that television networks separate their revenue plans into commercial income from corporate advertising budgets and income from political entities and public administrations, such as the Presidency of the Republic, Secretariats, Senate, Governorships, and Local Congresses.

In other words, the commercial and negotiation efforts of the agents involved in TV network negotiations are not influenced by the presidential election. There is no budget transfer between the political sector and the corporate sector.

The Law of Supply and Demand applies, but there is no budget transfer simply because it is an election year.

FOURTH CONSIDERATION: DO ADVERTISING PRICES INCREASE DUE TO SATURATION IN AN ELECTION YEAR?

Once again: NO.

When we consider the presidential election of Enrique Peña Nieto (2012) and the election of Andrés Manuel López Obrador (2018), in the first case there was a 2.2% increase in TV rates, while in the second case, rates decreased by 1.7%.

Rates will be more influenced by where we are coming from (a 0.9% increase in rates in 2023) and the inflation rate (which will likely close the year around 3.5%) than by the electoral year effect (remember, the presidential elections are on June 2, and there is still much of the year ahead).

Fifth Consideration: Information is Power

Regular and ongoing knowledge of negotiation closures, investment increases, and the evolution of negotiation conditions is crucial for ensuring efficient management of a company’s budget.

In an election year, it is even more important to have the mechanisms and data needed to establish a sound negotiation strategy.

What is said and commented on will vary depending on the source of information, but the reality can be quite different.

What typically occurs in election years is a greater dispersion of results; in other words, averages or mean data are often not very reliable, as there can be substantial differences in negotiation outcomes between companies. The same investment situation for one advertiser compared to another can lead to significant variations in tariff increases or decreases.

ELECCIONES PRESIDENCIALES 2024

México ira a las urnas el próximo verano para elegir a su presidente, también se pondrán a votación más de 20,000 cargos, incluyendo senadurías, diputaciones, gubernaturas y puestos en congresos locales. La cita con las urnas de mayor volumen hasta ahora.

Y ante esta situación la pregunta que se hace todo director de marketing, director de compras o responsable del presupuesto publicitario dentro de una compañía es:

¿Cómo afecta esto de cara a la negociación con las televisoras?

Additional Points to Consider

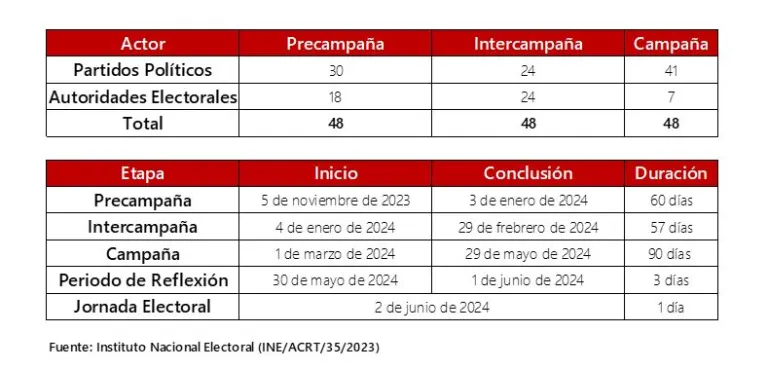

Political actors have limitations and guidelines for placing their ads on television and radio.

Federal Elections

Political parties and electoral authorities will have the following daily minutes available on each radio station and television channel combined. This will apply to the different stages of the campaigns.